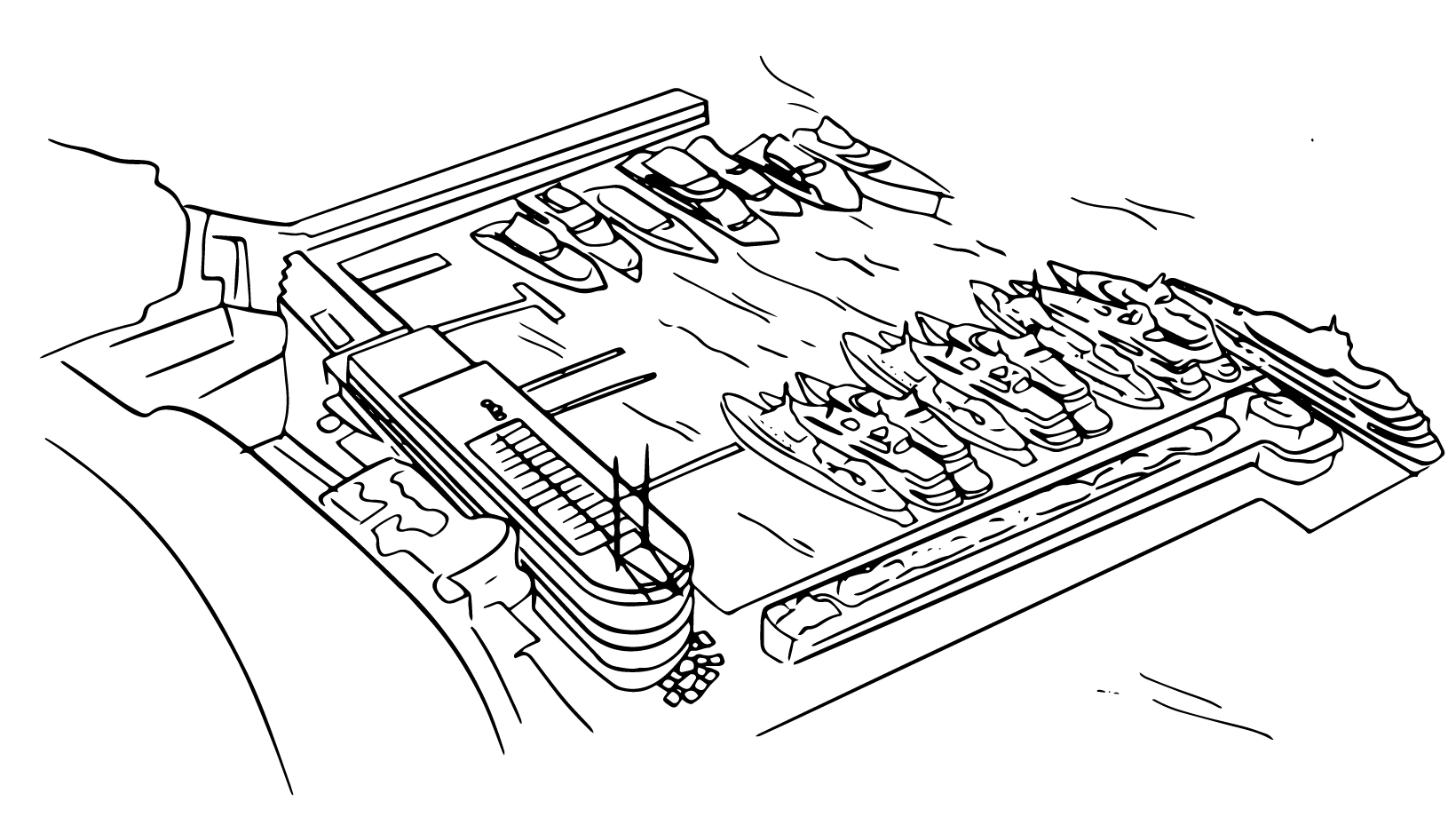

Fondé en 1953 par le Prince Rainier et présidé depuis 1984 par S.A.S. le Prince Souverain Albert II, le Yacht Club de Monaco réunit 2 500 membres, répartis en 81 nationalités. Regroupant les plus prestigieux yachts privés au monde sous son guidon, le Y.C.M. occupe désormais une place unique dans l’univers du Yachting et de la grande plaisance internationale.

Le Yacht Club de Monaco est un club exclusif, dédié à ses membres, qu’ils soient propriétaires ou capitaines de super yachts.

Institution emblématique, le Yacht Club de Monaco promeut la Principauté via ses événements et un yachting responsable. Club exclusif, il réunit propriétaires et capitaines de super yachts.

Conformément à ses statuts et à sa mission de servir «de trait d’union entre les gens qui aiment la mer et les intérêts touristiques et de promotion de la Principauté», le Yacht Club de Monaco organise, tout au long de l’année, de nombreux événements sportifs et sociaux, comme en témoigne son programme 2025.

Monaco, Capital of Advanced Yachting, se positionne à l’avant-garde de l’innovation durable dans l’industrie du yachting, en mettant en œuvre des initiatives novatrices. Grâce à ces efforts, Monaco façonne un avenir où performance et durabilité se rejoignent au service du yachting de demain.